Pharma and Biotech industries

Biotechnology is the research and development in the laboratory using bioinformatics for exploration, extraction, exploitation, and production from any living organisms and any source of biomass by means of biochemical engineering where high value-added products could be planned (reproduced by biosynthesis, for example), forecasted, formulated, developed, manufactured, and marketed for the purpose of sustainable operations (for the return from bottomless initial investment on R & D) and gaining durable patents rights (for exclusives rights for sales, and prior to this to receive national and international approval from the results on animal experiment and human experiment, especially on the pharmaceutical branch of biotechnology to prevent any undetected side-effects or safety concerns by using the products). The utilization of biological processes, organisms or systems to produce products that are anticipated to improve human lives is termed biotechnology.

Pharmaceutical Industry in INDIA

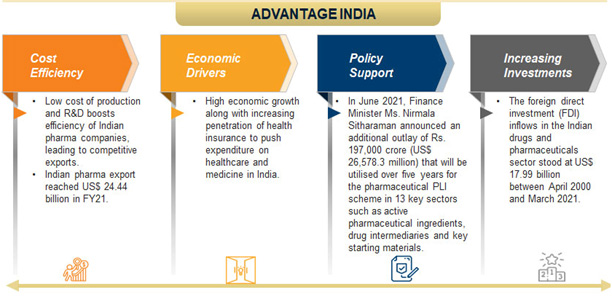

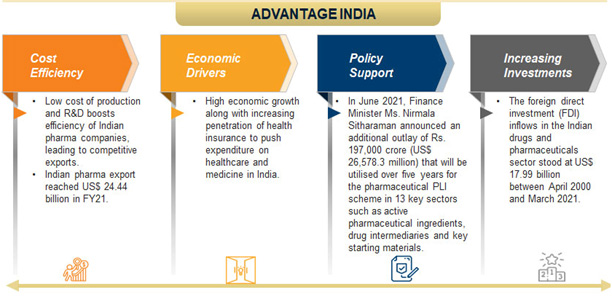

India is the largest provider of generic drugs globally. Indian pharmaceutical sector supplies over 50% of global demand for various vaccines, 40% of generic demand in the US and 25% of all medicine in the UK. Globally, India ranks 3rd in terms of pharmaceutical production by volume and 14th by value. The domestic pharmaceutical industry includes a network of 3,000 drug companies and ~10,500 manufacturing units. India enjoys an important position in the global pharmaceuticals sector. The country also has a large pool of scientists and engineers with a potential to steer the industry ahead to greater heights.

Presently, over 80% of the antiretroviral drugs used globally to combat AIDS (Acquired Immune Deficiency Syndrome) are supplied by Indian pharmaceutical firms.

Why INDIA is holding a great position globally?

Types of Companies

As promising as the future is for a whole, the outlook for small and medium enterprises (SME) is not as bright. The excise structure changed, so that companies now have to pay a 16% tax on the maximum retail price (MRP) of their products, as opposed to on the ex-factory price. Consequently, larger companies cut back on outsourcing and what business is left shifted to companies with facilities in the four tax-free states – Himachal Pradesh, Jammu and Kashmir, Uttarakhand, and Jharkhand. Consequently, a large number of pharmaceutical manufacturers shifted their plant to these states, as it became almost impossible to continue operating in non-tax free zones. But in a matter of a couple of years the excise duty was revised on two occasions, first it was reduced to 8% and then to 4%. As a result, the benefits of shifting to a tax free zone were negated. This resulted in, factories in the tax free zones, to start up third-party manufacturing. Under this these factories produced goods under the brand names of other parties on job work basis. As SMEs wrestled with the tax structure, they were also scrambling to meet the 1 July deadline for compliance with the revised Schedule M Good Manufacturing Practices (GMP). While this should be beneficial to consumers and the industry at large, SMEs have been finding it difficult to find the funds to upgrade their manufacturing plants, resulting in the closure of many facilities. Others invested the money to bring their facilities to compliance, but these operations were located in non-tax-free states, making it difficult to compete in the wake of the new excise tax.

By market capitalisation in Indian stock exchange-Top 10 listed pharmaceutical companies in India by market capitalization as of August 2021

| Rank | Company | Market Capitalization August ,21 (INR Crore) |

|---|---|---|

| 1 | Sun Pharma | 182,469 |

| 2 | Divi’s Laboratories | 128,794 |

| 3 | Dr. Reddy’s Laboratories | 75,113 |

| 4 | Cipla | 73,042 |

| 5 | Gland Pharma | 64,163 |

| 6 | Cadilla Healthcare | 55,727 |

| 7 | Torrent Pharmaceuticals | 51,927 |

| 8 | Alkem Laboratories | 45,759 |

| 9 | Lupin | 41,917 |

| 10 | Aurobindo Pharma | 39,328 |

By sales and marketing operations within India

Multinational Pharmaceutical Companies ranked as per active presence of sales, marketing and business in India are as follows:

1. Pfizer

2. GlaxoSmithKline

3. Sanofi Aventis

4. Merck

5. Johnson and Johnson

6. Amgen

7. Novartis

8. Roche

Investments and Recent Developments

The Union Cabinet has given its nod for the amendment of existing Foreign Direct Investment (FDI) policy in the pharmaceutical sector in order to allow FDI up to 100% under the automatic route for manufacturing of medical devices subject to certain conditions. The drugs and pharmaceuticals sector attracted cumulative FDI inflow worth US$ 17.75 billion between April 2000 and December 2020 according to the data released by Department for Promotion of Industry and Internal Trade (DPIIT). Some of the recent developments/investments in the Indian pharmaceutical sector are as follows:

- Lupin Digital Health Ltd., a wholly owned subsidiary, to provide a digital In June 2021, Sun Pharmaceuticals acquired the patent license for Dapagliflozin from AstraZeneca. The company will be distributing and promoting the drug under the brand name ‘Oxra’

- In June 2021, Lupin Ltd. announced its intention to enter the digital healthcare space in India. It incorporated therapeutics platform for medical practitioners and patients in the country.

- In May 2021, the Government of India invited R&D proposals on critical components and innovations in oxygen concentrators by June 15, 2021.

- In May 2021, Indian Immunologicals Ltd. (IIL) and Bharat Immunologicals and Biologicals Corporation (BIBCOL) inked technology transfer pacts with Bharat Biotech to develop the vaccine locally to boost India's vaccination drive. The two PSUs plan to start production of vaccines by September 2021.

- In May 2021, Eli Lilly & Company issued non-exclusive voluntary licenses to pharmaceutical companies—Cipla Ltd., Lupin Ltd., Natco Pharma & Sun Pharmaceutical Industries Ltd.—to produce and distribute Baricitinib, a drug for treating COVID-19.

- In April 2021, the CSIR-CMERI, Durgapur, indigenously developed the technology of Oxygen Enrichment Unit (OEU). The unit can deliver medical air in the range of ~15 litres per minute, with oxygen purity of >90%. It transferred the technology to MSMEs—Conquerent Control Systems Pvt. Ltd., A B Elasto Products Pvt. Ltd. and Automation Engineers, Mech Air Industries and Auto Malleable.

- In April 2021, National Pharmaceutical Pricing Authority (NPPA) fixed the price of 81 medicines including off-patent anti-diabetic drugs allowing due benefits of patent expiry to the patients.

- In February 2021, Aurobindo Pharma announced plans to procure solar power from two open access projects of NVNR Power and Infra in Hyderabad. The company will acquire 26% share capital in both companies with an US$ 1.5 million investment. The acquisition is expected to be completed by the end of March 2021.

- In February 2021, the Telangana government partnered with Cytiva to open a ‘Fast Trak’ lab to strengthen the biopharma industry of the state.

- In February 2021, Glenmark Pharmaceuticals Limited launched SUTIB, a generic version of Sunitinib oral capsules, for the treatment of kidney cancer in India.

- In February 2021, Natco Pharma launched Brivaracetam for the treatment of epilepsy in India.

- In February 2021, the Russian Ministry of Health allowed Glenmark Pharmaceuticals to market its novel fixed-dose combination nasal spray in Russia.

- In January 2021, the Central government announced to set up three bulk drug parks at a cost of Rs. 14,300 crore (US$ 1,957 million) to manufacture chemical compounds or active pharmaceutical ingredients (APIs) for medicines and reduce imports from China.

- PharmEasy received US$ 300 million in July 2021 from its existing investors after acquiring Thyrocare, the diagnostic firm. These funds will be utilised to continue Thyrocare's acquisition process. After the transaction is completed, the online pharmacy plans to float the company on the Indian Stock Exchange.

Conclusion: Medicine spending in India is projected to grow 9 12% over the next five years, leading India to become one of the top 10 countries in terms of medicine spending. Going forward, better growth in domestic sales would also depend on the ability of companies to align their product portfolio towards chronic therapies for diseases such as such as cardiovascular, anti-diabetes, anti-depressants and anti-cancers, which are on the rise. The Indian Government has taken many steps to reduce costs and bring down healthcare expenses. Speedy introduction of generic drugs into the market has remained in focus and is expected to benefit the Indian pharmaceutical companies. In addition, the thrust on rural health programmes, lifesaving drugs and preventive vaccines also augurs well for the pharmaceutical companies.

Biotech Industry in INDIA

The Indian Biotechnology industry that was valued at $70 bn in 2020 will reach $150 bn target by 2025. The sector is divided into five major segments: BioPharma, BioAgriculture, BioIndustrial, and the combined segment of BioServices comprising of BioIT, CROs, and Research Services. The percentage share of the biotechnology segments is:

• Bio-Pharmaceuticals: 62%

• CRO/BioIT/Research: 15%

• Bio-agriculture: 16%

• Bio-Industrial: 7%

India is among the top 12 destinations for biotechnology worldwide. The industry comprises >2,700 biotech start-ups and >2,500 biotech companies in the country. India has 665 FDA-approved plants the US; 44% of the global abbreviated new drug applications (ANDA) and >1400 manufacturing plants, which are compliant with WHO. The country is also the world’s third-largest producer of recombinant Hepatitis B vaccine and second-largest producer of BT cotton (genetically modified pest resistant plant cotton)

Market Size

The Indian biotechnology industry amounted to US$ 63 billion in 2019 and is forecast to reach US$ 150 billion by 2025, with a CAGR of 16.4%. By 2025, the contribution of the Indian biotechnology industry in the global biotechnology market is expected to grow to 19% from 3% in 2017. Biopharmaceutical is the largest segment that contributed ~58% to the Indian biotechnology market in 2019, followed by bio-agriculture, which accounted for 19% and bio-services, which accounted for 15% in 2019. The Indian biologics market is expected to register a CAGR of 22% from 2019 to 2025 to reach US$ 12 billion by 2025. Bio-services, which accounted for 15% of the biotechnology industry in India, is becoming a leading destination for clinical trials, contract research and manufacturing activities in the country.

Why INDIA is holding a great position globally?

Size of Industry

Today, there are more than 350 biotechnology companies in India providing employment to more than 20,000 scientists. Biotechnology Industry Research Assistance Council (BIRAC) established by the Department of Biotechnology (DBT) is aimed at strengthening and empowering the emerging biotechnology enterprises to undertake strategic research and innovation.

Top companies are –

1. Biocon

2. Serum Institute of India

3. Panacea Biotech

4. Nicolas Piramal

5. Wockhardt

6. GlaxosmithKline

7. Bharat Serum

8. Krebs Biochemicals and Industries ltd

9. Zydus cedilla

10. Indian Immunologicals

Investments and Recent Developments

India allows 100% FDI under the automatic route (a non-resident or Indian company will not require any approval from the government) for greenfield pharmaceuticals and manufacturing medical devices. Some recent developments/investments in the Indian chemical sector are as follows:

- • In May 2021, Indian Immunologicals Limited (IIL) and Bharat Immunologicals and Biologicals Corporation (BIBCOL) inked technology transfer pacts with Bharat Biotech to develop the vaccine locally to boost India's vaccination drive. The two PSUs plan to start the production of vaccines by September 2021.

- • In April 2021, the Department of Biotechnology (DBT), Ministry of Science & Technology, approved additional funding towards clinical studies for India’s ‘first-of-its-kind' mRNA-based COVID-19 vaccine, HGCO19, developed by Pune-based Gennova Biopharmaceuticals Ltd.

- • In April 2021, Drug Controller General Of India (DCGI) gave a restricted emergency use approval to the Zydus Cadila’s ‘Virafin’ for treating patients with moderate COVID-19 symptoms. Virafin is a pegylated interferon alpha-2b(PegIFN), which when subcutaneously injected to the patient in the early stages of infection, resulted in their faster recovery.

- • In April 2021, the CSIR-CMERI, Durgapur, indigenously developed an ‘oxygen enrichment technology’, which may be effective for treating COVID-19 patients. The oxygen enrichment unit can deliver medical air in the range of up to 15 litres per minute, with oxygen purity of >90%.

- • In March 2021, Cytiva, a global science player and the Telangana government partnered to open a 10,000 sq.ft. Fast Trak lab to accelerate and advance the local biopharma scale-up needs.

- • In March 2021, Gland Pharma Ltd. announced that it will produce 252 million doses of the Sputnik V COVID-19 vaccine in the third quarter of 2021.

- • In February 2021, the Government of India announced multiple initiatives such as setting up 10 biotech University Research Joint Industry Translational (URJIT) clusters, forming umbrella structures in nine cities for better coordination among R&D institutes and focusing on identified national priority thrust area under National Research Foundation (NRF).

- • In January 2021, Biocon Biologics, the biosimilar arm of Biocon, received an investment of Rs. 555 crore (US$ 75 million) from Abu Dhabi’s sovereign wealth fund, ADQ.

- • In January 2021, India’s first indigenously developed DNA vaccine candidate against COVID-19, ZyCoV-D, by Zydus Cadila, has received approval by Drugs Controller General of India (DCGI), to conduct the Phase III clinical trials. The candidate has been supported by the National Biopharma Mission (NBM), under the sponsorship of BIRAC and the Department of Biotechnology, Government of India.

- • In January 2021, Bharat Biotech plans to produce 700 million doses of its COVID-19 vaccine in 2021. The company announced that it will be establishing four facilities and is planning to manufacture 200 million doses in Hyderabad and 500 million does in other cities.

Conclusion:

Indian biotechnology is built on entrepreneurship, innovation, developing domestic talent and demonstrating value-based care. Given the long history of diseases in India, the country has accumulated years of experience and scientific knowledge to prevent and treat them. India is working to boost the biotechnology sector under the flagship programmes such as 'Make in India' and 'Start-up India'. Increase in the number of biotech incubators will boost research and promote growth of start-ups; this is critical for the success of the Indian biotech industry.

Reference Taken:

https://www.ibef.org/industry/biotechnology-india.aspx

Garima Bharati- Sr. HR Consultant

- Healthcare Ecommerce/Retail

Mayukhi Saha- HR Consultant

- Hospital & Healthcare Delivery

Sujoy Ghosh

- Pharma & Diagnostic

Ripshika Dey- HR Consultant

- Medical Device

Samarpita Misra- HR Consultant

- Clinical Research Organization & R&D services

Poulami S. Neogi- HR Consultant

- Health Insurance/TPA

Dipalok Biswas- HR Consultant

- Healthcare IT